Daycare & Preschool Insurance

Running a childcare business such as a daycare center or preschool comes with numerous potentially expensive risks, including lawsuits and more.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

The daycare and preschool industry is one that comes with a large number of risks that must be considered from the very start. From injuries to the children in your care to lawsuits and beyond, many different incidents can threaten your business's livelihood. Fortunately, having preschool and daycare insurance can help you prepare for these risks and get the reimbursement you desperately need in case of a disaster.

A local independent insurance agent can help you find the right preschool and daycare insurance policy. They'll get you set up with coverage that addresses all the potential risks unique to your industry. But first, here's a breakdown of daycare insurance and what it covers.

What Is Daycare and Preschool Insurance?

Daycare insurance is a specific type of business insurance designed to meet the unique needs of childcare businesses. It provides business owners with much-needed daycare liability insurance coverage as well as commercial property coverage. Since kids are prone to accidents, it's imperative for daycare owners to be equipped with ample legal protection in case they are sued.

Daycare insurance is a customizable form of business insurance. It provides policyholders with the basic protections most businesses need and is topped off with specific coverages required for childcare centers, including daycares and preschools.

Top Risks for Daycares and Preschools

When you run a daycare or a preschool, there are all kinds of risks. From the children you watch to the adults who drop them off and pick them up, there are hazards around each corner. Here are some of the most common you need to be prepared for:

- Liability risks: If any children get injured or ill as a result of your business practices, you could face an ugly lawsuit.

- Property risks: Your daycare's building, whether it's your home or a separate office structure, needs protection against the harsh elements of nature, vandalism, and more.

- Premises risks: Slips and falls are some of the most common premises liability claims filed by businesses of all kinds, including preschools and daycares.

- Auto liability risks: If your daycare transports children to field trips, etc., you need to be certain you're covered with the right business auto insurance.

- Abuse and molestation risks: Sadly, children are vulnerable to threats like abuse and molestation from adults or older kids while away from home.

- Workers comp risks: Your daycare also needs to take care of its employees to help prevent losses stemming from injuries and illness on the job.

An independent insurance agent can help you build a complete preschool and daycare insurance policy.

Who Needs Daycare and Preschool Insurance?

Daycare insurance is usually required. Childcare centers and nursery schools must carry daycare liability insurance to be licensed by the Department of Health and Human Services (HHS), and most states require licensure for a daycare business to operate legally.

While the HHS has strict guidelines that your business must adhere to, your insurance company may have even stronger requirements that will affect your daycare insurance costs. These requirements exist to limit your exposure to lawsuits.

The HHS doesn't require liability insurance to license home-based daycare businesses. However, your homeowners insurance policy may require you to carry a business insurance policy or purchase specific endorsements to protect your business. Your insurer may even refuse to renew your policy if they discover you've been running a business out of your home without home daycare insurance.

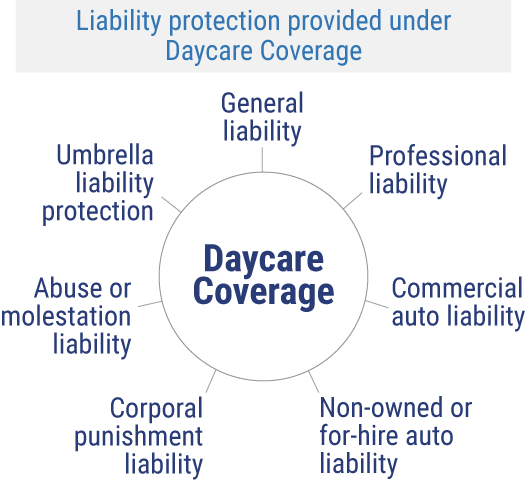

Essential Daycare and Preschool Business Insurance Liability Coverage

Many instances could arise in which your daycare business or preschool faces a lawsuit. Even if the charges are dropped, the ensuing legal defense fees can be very expensive. Liability insurance covers court costs and legal fees associated with covered events.

- General liability insurance: This covers property damage and injuries suffered by third parties while on your property.

- Professional liability insurance: Errors and omissions insurance can protect against lawsuits if a member of your staff is blamed for showing negligence of the children’s safety, including claims of mental, physical, or emotional abuse of the children.

- Commercial auto liability insurance: This is required if your daycare business uses company vehicles to transport children to and from schools.

- Non-owned or hired auto liability insurance: This coverage protects privately owned vehicles when they are being used for company business.

- Corporal punishment liability insurance: If one of your employees strikes a child or is accused of administering corporal punishment, this coverage can pay for legal defense costs.

- Abuse and molestation liability insurance: This can cover lawsuit costs and other expenses if your business faces a claim of abuse or molestation.

- Commercial umbrella insurance: This coverage provides additional liability protection that can extend your existing policy limits to $1 million or greater. Larger daycare and preschool facilities may benefit from this added coverage.

To get your daycare or preschool set up with the complete picture of liability protection, work with a local independent insurance agent.

Essential Daycare and Preschool Business Insurance Property Coverage

Daycare and preschool business operations often invest a lot of capital in equipment to keep the children entertained during the day. A preschool and daycare insurance policy can provide you with compensation if your business property is lost or damaged. Coverage needs differ slightly for those who run their business in-home vs. outside.

Commercial property insurance can cover your preschool or daycare business's office and other buildings and contents, including cribs, sandboxes, toys, books, sound systems, and electronics. If any of your business property is lost or damaged by fire, extreme weather, vandalism, or theft, you may be able to receive reimbursement for your loss.

If your business is operated out of your home, you may need to add a special endorsement to your homeowners insurance to protect your commercial property. An independent insurance agent can help your daycare get equipped with all the property coverage it needs to maintain smooth operations.

Additional Types of Coverage to Consider

Daycare and preschool insurance can provide other insurance options that may also be beneficial to your childcare business, such as:

- Field trip insurance: This provides liability and property damage coverage while you are providing childcare services off-site.

- Special events liability coverage: If your facility hosts a special event like a holiday party, fundraiser, or pageant, this one-time insurance policy can provide liability protection during the event.

- Business income coverage: If your facility is forced to temporarily close due to a covered incident, this can reimburse you for lost income and continue paying ongoing expenses such as employee wages and rent.

- Workers compensation: Likely required by law in your state, this coverage can pay for medical expenses and provide partial wage replacement for employees who get injured or ill due to their jobs.

An independent insurance agent can recommend the most important coverage additions to your daycare or preschool insurance policy.

How Much Does Daycare and Preschool Insurance Cost?

The cost of your daycare insurance policy can vary greatly, depending on several factors. These can include the following:

- Your annual revenue

- Your location

- Number of employees

- Your claims history

- Your chosen deductible and coverage limits

- Your preschool or daycare's size

A local independent insurance agent can help you find exact preschool and daycare insurance quotes near you.

Who Sells Daycare and Preschool Insurance?

Daycare insurance is available from many different insurance companies, but the best way to find the right carrier for you is by working with an independent insurance agent. While many insurance companies could create a daycare insurance policy for you, finding coverage could also depend on the area you live in. Here are just a few of our top picks:

| Top Daycare Insurance Companies | Overall Carrier Star Rating |

| Markel |

|

| Philadelphia Insurance Companies |

|

| CyberPolicy |

|

| The Hartford |

|

| Next Insurance |

|

| American Family Insurance |

|

| Assure Child Care |

|

An Independent Insurance Agent Can Help You Find Daycare and Preschool Insurance

When it comes to finding the proper protection for your childcare business, no one's better equipped to help than a local independent insurance agent. These agents are free to shop and compare policies from multiple carriers for you. And down the road, your agent can help you file business insurance claims and update your coverage as your company evolves.

Frequently Asked Questions about Daycare and Preschool Insurance

You'll need different types of coverage depending on the size and style of your daycare business. If your daycare business is larger and has at least one separate office space, you'll need business property coverage for each location. The biggest difference in pricing is the overall size of your daycare business or its annual revenue.

The cost of your liability coverage under your daycare insurance policy depends on several factors. These can include the size of your childcare business and your prior claims history.

To know which type of workers comp coverage you need for your daycare, work with an independent insurance agent. They'll know what type of coverage is required in your area for businesses in the daycare industry.

Depending on the types of coverage you select for your daycare insurance policy, coverage can apply to field trips, outdoor activities, routine indoor activities, guests' visits, playtime activities, and more. Enlist the help of an independent insurance agent to ensure your daycare's various activities and operations are fully covered.

Your business could face a lawsuit if a child gets hurt at your daycare or preschool. Whether the injury was intentional or accidental, your business must be equipped with adequate liability insurance to protect you. If the child's parents sue your preschool or daycare, your liability insurance can reimburse you for legal fees, such as attorney and court costs, whether you're found guilty or not. If you lose the case, liability insurance can reimburse for settlement fees, as well.

https://www.thehartford.com/employee-benefits/producers/preschool-daycare-insurance