Average Cost of Motorcycle Insurance for 2025

Find out the average cost of a motorcycle insurance policy by rider age, motorcycle type, state, and more.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

The average cost of motorcycle insurance is $399 per year or about $33 per month. The cost varies depending on a number of different factors, including your location and age, the type of motorcycle you own, your specific insurance company, and more.

Motorcycle insurance can help protect against costs associated with accidents, liabilities, theft, vandalism, and more. An independent insurance agent factors in your location, motorcycle type, how much coverage you need, and more when determining the amount and types of coverage that are best for you.

In this article, we'll break down some major factors influencing motorcycle insurance costs and how each may affect premium rates.

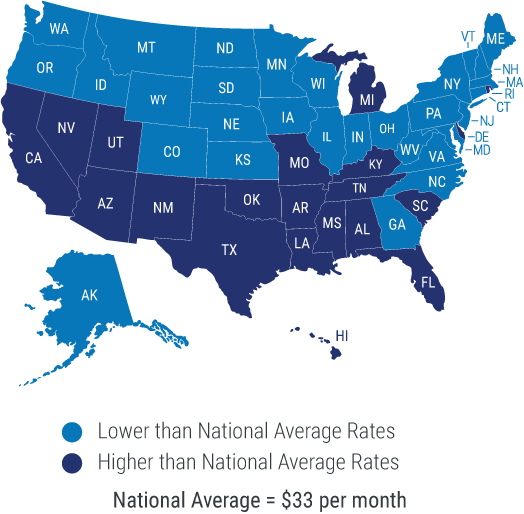

Average Motorcycle Insurance Cost by State

The chart below shows the average monthly cost of motorcycle insurance by state. It also shows how your state compares to the national average.

| State | Average Monthly Cost of Motorcycle Insurance |

|---|---|

| Alabama | $40 |

| Alaska | $27 |

| Arizona | $49 |

| Arkansas | $36 |

| California | $46 |

| Colorado | $33 |

| Connecticut | $29 |

| Delaware | $36 |

| Florida | $54 |

| Georgia | $38 |

| Hawaii | $45 |

| Idaho | $27 |

| Illinois | $29 |

| Indiana | $28 |

| Iowa | $18 |

| Kansas | $25 |

| Kentucky | $69 |

| Louisiana | $44 |

| Maine | $21 |

| Maryland | $32 |

| Massachusetts | $21 |

| Michigan | $38 |

| Minnesota | $28 |

| Mississippi | $48 |

| Missouri | $41 |

| Montana | $22 |

| Nebraska | $24 |

| Nevada | $39 |

| New Hampshire | $27 |

| New Jersey | $25 |

| New Mexico | $36 |

| New York | $27 |

| North Carolina | $23 |

| North Dakota | $18 |

| Ohio | $27 |

| Oklahoma | $37 |

| Oregon | $32 |

| Pennsylvania | $31 |

| Rhode Island | $34 |

| South Carolina | $44 |

| South Dakota | $20 |

| Tennessee | $41 |

| Texas | $46 |

| Utah | $43 |

| Vermont | $21 |

| Virginia | $31 |

| Washington | $29 |

| West Virginia | $33 |

| Wisconsin | $23 |

| Wyoming | $27 |

Most Expensive States for Motorcycle Insurance

Motorcycle insurance costs are higher in certain states than in others. Many factors can be responsible for this, including the state's general risk for motorcycle theft and other crimes, natural disasters, and other common causes of vehicle damage.

The top 5 most expensive states for motorcycle insurance are:

| # | State | Average Monthly Cost |

|---|---|---|

| 1 | Kentucky | $69/month |

| 2 | Florida | $54/month |

| 3 | Arizona | $51/month |

| 4 | Mississippi | $48/month |

| 5 | Texas | $46/month |

Least Expensive States for Motorcycle Insurance

Motorcycle insurance is also much cheaper than average in select states. This can be due to the inverse of factors mentioned above, such as a statistically lower risk of motorcycle theft or natural disasters.

The top 5 least expensive states for motorcycle insurance are:

| # | State | Average Monthly Cost |

|---|---|---|

| 1 | North Dakota | $18/month |

| 2 | Iowa | $18/month |

| 3 | South Dakota | $20/month |

| 4 | Maine | $21/month |

| 5 | Massachusetts | $21/month |

Average Motorcycle Insurance Cost By Age

Just like with car insurance, young riders can expect to pay more for motorcycle insurance than more experienced riders. In fact, an 18-year-old rider can expect to pay up to 41% more for his or her coverage than a rider who is 35 years old.

Statistically speaking, younger riders are much more likely to get into accidents or end up with other traffic violations due to inexperience or riskier driving behaviors. As such, insurance companies compensate for the increased risk with more expensive premiums. The table below breaks down the average cost of motorcycle insurance by rider age.

| Rider Age | Average Monthly Cost of Motorcycle Insurance |

|---|---|

| 16 | $340 |

| 18 | $244 |

| 21 | $194 |

| 35 | $173 |

| 50 | $191 |

Average Motorcycle Insurance Cost By Motorcycle Type

The cost of motorcycle insurance also varies widely depending on the specific type of bike you own. For example, you can expect to pay a lot more for a policy covering a sport or supersport bike than you would for another kind of motorcycle, partially due to the increased risk of theft and accidents. The table below breaks down the average cost to insure several popular types of motorcycles.

| Type of Motorcycle | Average Monthly Cost of Motorcycle Insurance |

|---|---|

| Cruiser | $143 |

| Scooter | $101 |

| Sport | $367 |

| Touring | $278 |

The value of your bike and its statistical risk of theft, along with its official crash test ratings and included safety features, all impact motorcycle insurance costs. Generally speaking, the safer your motorcycle is and the less likely it is to get stolen, the cheaper your insurance rates will be.

On the other hand, a more valuable bike that's more expensive to replace will cost more to insure. Likewise, if it's more likely to be stolen or has lower safety ratings, your motorcycle insurance cost will likely be higher than average.

Average Motorcycle Insurance Cost by Insurance Company

The insurance company you buy your motorcycle insurance from also heavily impacts its cost. Many insurance companies offer discounts, but a few don't. The types of coverage you select for your policy will, of course, impact your premium rates, as will all the factors discussed above.

We found that one of the cheapest motorcycle insurance carriers was Dairyland, with average rates of just $22 per month. Here are some average monthly motorcycle insurance rates by insurance company.

| Insurance Company | Average Monthly Cost of Coverage | Overall Carrier Star Rating |

|---|---|---|

| Progressive | $23 |

|

| Nationwide | $55 |

|

| Dairyland | $22 |

|

| Markel | $40 |

|

| Harley Davidson | $24 |

|

What Does Motorcycle Insurance Cover?

The type of coverage you buy for your motorcycle will vary depending on your unique needs. However, your policy must at least meet your state's minimum coverage requirements. You'll be able to choose from the following types of coverage for your motorcycle insurance policy, among others:

- Bodily injury and property damage liability coverage: Pays for costs associated with causing bodily injury or property damage to third parties with your motorcycle. Liability coverage is required by law in most states.

- Collision coverage: Pays for damage to your motorcycle from a collision with another driver or rider, regardless of fault.

- Comprehensive coverage: Pays for damage to your motorcycle due to a non-collision event, such as a flood or theft.

- Medical payments coverage: Pays for costs related to medical treatments for your own injuries or injuries to your passengers after an accident, regardless of fault.

- Custom parts, equipment, or accessories coverage: Pays for custom parts and accessories you've added to your bike if they get stolen, vandalized, or damaged.

An independent insurance agent can help you build the right motorcycle insurance policy for you.

Understanding the Cost of Motorcycle Insurance

Motorcycle insurance costs vary widely depending on where you buy your coverage, how much coverage you need, the type of bike you have, your driving history, and other factors. When looking at your policy's premium rates, consider that all of the following factors are part of the equation that determines what you'll pay:

- How much coverage you need (i.e., your coverage limits)

- The coverage options you select

- The deductible you select

- Where you live

- Your age

- The kind of bike you have

- The value of your bike

- Any discounts you qualified for

An independent insurance agent can help you find all the motorcycle insurance discounts you can apply to your policy to help you save the most money possible.

Methodology

To compare average motorcycle insurance rates, Trusted Choice evaluated quotes for each of the 50 states and Washington, D.C. To gather specific data for sample drivers, we used a motorcycle insurance policy that includes the following:

- Bodily injury liability coverage: $50,000 per person; $100,000 per accident

- Property damage liability coverage: $25,000 per accident

- Medical payments coverage: $5,000

- Comprehensive and collision coverage deductible amount: $500

- Uninsured and underinsured motorist bodily injury coverage: $50,000 per person; $100,000 per accident

- Uninsured and underinsured motorist property damage coverage: $25,000 per accident

Trusted Choice compared quotes from several top motorcycle insurance companies nationwide to discern the average cost per state. Quotes pulled from each carrier were based on a motorcycle owner aged 45 with a 2018 Honda CMX500 Rebel bike and a full coverage policy.

For the average quotes by rider age section, Trusted Choice collected data based on a rider in Los Angeles with a clean driving history who has been licensed and insured since age 16 or for at least 10 years.

How Can an Independent Insurance Agent Help You Find the Best Motorcycle Insurance?

Independent insurance agents want to help you get a policy that meets all your coverage needs at the best possible price. These agents work for you, not for an insurance company.

Your local agent will ensure that you have a policy that provides the important coverage you need and will help you find ways to save on your premium. Find a local independent insurance agent in your neighborhood today and get free motorcycle insurance quotes and personal assistance.

https://www.valuepenguin.com/average-cost-of-motorcycle-insurance