Maine Restaurant Insurance

An independent insurance agent near you can help.

When you think of Maine, you might think of baked beans, corn chowder, lobster rolls, and any other kind of seafood, for that matter.

Your restaurant could serve any one of these delicious favorites or anything else, and you all still have one thing in common: You need restaurant insurance. And when you need restaurant insurance, you need an independent insurance agent to guide the way.

Risks in Maine Restaurant Insurance

Restaurant insurance will look different for every business, but the factors that affect costs and play into underwriter concerns about risks are all the same:

- What food are you cooking?

- How are you preparing that food?

- How many employees do you have?

- What are your employees doing?

- How much risk is there in the kitchen?

- What kind of property is there to account for?

- Is there any specialty property?

This isn’t an all-inclusive list. But it does hit on the major variables that an underwriter will have to evaluate when they're looking at your restaurant. The more you know about each, the easier it’ll be to put together your policy, because you can work better with your independent insurance agent to account for anything and everything you might want covered.

Restaurant Property Insurance in Maine

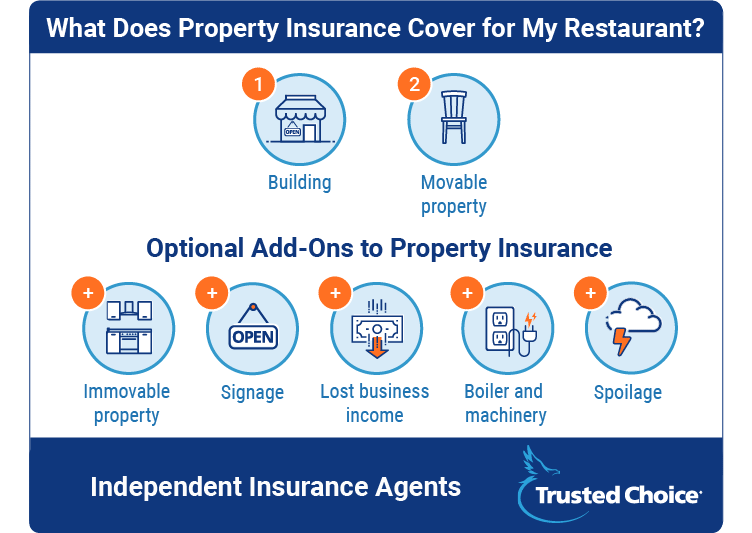

The first kind of insurance you need for your restaurant is property insurance. It’s important to note that there's general property insurance, and then a lot of specialized options to extend coverage.

Your basic property policy will cover the replacement value of:

- Your building

- Movable property inside the building

Movable property is just what it sounds like: It’s property that you can shuffle around, like your furniture. As you can guess, this also means that there’s another type of property in the building: immovable personal property. This is generally your kitchen equipment, or even built-in furniture. It’s literally what would be personal property but has been bolted to or attached to the building in some way. Typically, this isn’t covered under your general property policy, so you’ll want to ask your independent agent what special coverage you might need.

In addition to immovable personal property, which is generally a specialty policy, there are other specialty policies, too. A few of the most common for restaurants in Maine include:

- Spoilage: This covers the cost of food that goes bad due to refrigeration or freezer failure. Although you might have a lot of fresh seafood in Maine, you could still lose a lot of money when something like this happens.

- Lost business income: This pays your restaurant’s bills, including employee salaries, if you’re closed due to a covered loss. This is typically after a kitchen fire or natural disaster that means you must close down for repairs. Note that if you’re getting loans from a bank, you might have to purchase this additional coverage.

- Signage: Do you have a fancy sign in front of your restaurant? Some do, and they can cost upwards of $100,000. Drive-through signs can also be expensive, depending on the restaurant. Sign coverage will ensure that both are protected.

- Equipment (boiler and machinery): If your HVAC or electric system malfunctions or breaks down, it can damage wiring or other equipment attached to it. Equipment coverage pays for the cost of the damage, even if it doesn’t pay for the cost of the equipment itself.

Restaurant Commercial Liability Insurance in Maine

There are three types of commercial liability insurance:

- General

- Liquor

- Officers and directors liability

General commercial liability insurance pays for something that happens to a customer while they’re at your restaurant. This would cover an accident – like if they slipped and fell on a wet floor – or a food-related illness.

Liquor liability coverage is absolutely required if you serve, sell, brew, or distill alcohol. Without it, any alcohol-related incidents won’t be covered under your general commercial liability coverage.

In fact, if you overserve a customer, there’s an accident, and you didn’t purchase specialized insurance to cover it, you’ll have to pay out of pocket for any:

- Property damage

- Bodily injury

As a note, most liquor liability policies start at a $1 million policy limit. However, most restaurants increase this to up to $5 million or more, since alcohol-related accidents can be incredibly costly.

Officer and director liability insurance is a much more specialized, less utilized special type of liability coverage. It arises when employees, stockholders, or cities bring a lawsuit – without damage or injury – against a restaurant for a “poor business decision.” Litigation costs can be high, and without this coverage, your restaurant could suffer. However, this is much more likely to happen to a bigger restaurant, or a multi-location corporate chain.

Restaurant Employee Insurance in Maine

There are two types of employee insurance:

- Workers' compensation, which is legally required

- Employment practices liability insurance, which is not legally required

You’ve probably heard of workers compensation. It’s the insurance that kicks in when an employee is injured on the job and covers their expenses for:

- Medical bills

- Rehabilitation

- Lost wages

Another type of employee insurance for Maine restaurants is employment practices liability insurance. This kind of insurance is better suited for larger restaurants, though it can be a good idea for smaller places as well! This coverage kicks in if an employee sues your restaurant alleging:

- Bad behavior

- Sexual harassment

- Hostile work environment

- Discrimination

The best part is that it defends the restaurant entity as well as officers of the restaurant. This can again save your restaurant from burdensome litigation costs, which can and have shut down some businesses in the past. That being said, it’s important to discuss this with your independent agent so you know whether it is a make or break component of your policy.

How Restaurant Features Can Affect Insurance Costs

Just as no two restaurants serve the same food, no two are set up the same way, either. Different features may or may not affect insurance costs and coverage options you should consider. Some of the most popular that you may want to discuss with your independent agent include:

- Drive-thrus: They typically don’t affect any aspect of your restaurant insurance. There may be some coverage concerns if you have an expensive sign in the drive-thru lane, but generally speaking, it won’t change much.

- Waiters: Having a wait staff won’t generally increase anything other than your workers' compensation coverage. The only reason it changes workers' compensation is because the more employees you have on your payroll, the higher the cost of this coverage will be.

- Carry-out: Just as having a wait staff at a dine-in restaurant increases insurance costs because of workers' compensation coverage, having a restaurant that is online carry-out means you need fewer employees and will therefore pay even less for coverage. Carry-out restaurants also have less movable property inside because customers aren’t staying to eat. This might mean property coverage is less expensive, too.

- Buffets: Not a lot of restaurants have buffets these days. However, underwriters tend to have a bias against them. The fact that food is sitting out and exposed to all your customers is something that you might end up paying more for (even if there isn’t much more of a justified risk).

- Delivery services: Delivery services mean your liability coverage will cost more. However, it won’t cost as much if you purchase your own delivery vehicles rather than allowing your drivers to use their own vehicles. The difference is that with your own vehicles, you know where they’re from and other specifics that matter when it comes to coverage.

If you have any of these features – or any others that you think may affect your policy – be sure to make a note of it with your agent.

How Your Maine Location Affects Restaurant Insurance

State-specific insurance coverage for restaurants doesn’t vary much. However, it can differ due to things like:

- The type of food you’re preparing and serving

- Regional differences in how you cook the food

The big concern with Maine is seafood. If you’re serving it raw, is the fish you’re serving fresh enough? If you’re deep frying it, how much danger are the employees in around the hot oil? All of these are concerns that can and will affect your liability coverage. This is because past-its-prime seafood can make customers sick. On the kitchen front with deep frying, your workers' compensation might increase because hot oil is dangerous. So are the sharp knives required to cook seafood!

Spoilage would be another concern, too. If you’re getting fresh fish, you won’t rely on frozen food as much. However, you’ll still need a refrigerator to keep your food and if that fails, you’ll lose a lot of money on fresh seafood.

Beans are another odd food-related concern. Some beans have stones in them, and they can crack teeth. This isn’t a hard and fast rule, but it could factor in to general liability coverage, too.

The Cost of Restaurant Insurance in Maine

It’s impossible to tell you what you’re going to pay for restaurant insurance in Maine before you start working with an independent agent to assess all of your unique features and risks. However, your costs will be broken down as follows:

- Property and liability

- Workers' compensation

The reason you pay for workers' compensation separately is because it's calculated differently. In fact, the two factors that affect what you pay for workers' compensation coverage are:

- Your total employee payroll (by $100)

- Your employees' risk classifications

Risk classifications typically hinge on how dangerous your kitchen environment is. If there are sharp knives, hot oil, and other dangerous cooking techniques (think open fire), then the risk classification will be higher and you’ll pay more for insurance.

Property and liability coverage are priced differently. Their combined cost on the low end could be $1,000 annually, whereas the higher end coverage can be $100,000 or more per year. The difference has a lot to do with restaurant size, risk, and location.

A corner food stand may have only five employees, no excessively dangerous kitchen equipment, and no “building” to cover for property insurance. On the other extreme is a restaurant with multiple locations, lots of pricey personal property, and higher risk in the kitchen (not to mention the potential for customer-related accidents on the premises). A food cart isn't likely to serve alcohol, but a restaurant will. All of these factors come together to affect the cost of insurance.

One additional note about valuing your insurance policy is valuing personal property in your restaurant. Consider this: You may have paintings in your restaurant, and each is worth a few thousand dollars. Without an appraisal, you’ll get the replacement value of those paintings. With an appraisal, you’ll get what they’re actually worth if they’re destroyed.

Talk to an Independent Insurance Agent about Restaurant Insurance in Maine

AN independent insurance agent will know what Maine restaurants need when it comes to insurance coverage. And while every restaurant will start with the basic property, liability, and employee policies, an independent agent will add on the specialty coverage you need to ensure that every potential risk is addressed and covered.

The best part is that independent insurance agents can work with multiple insurers to get a range of options, so you never have to settle. You'll get the best coverage at the best price - guaranteed.