Maine Hotel Insurance

So you and your guests can be as relaxed as possible.

Paul Martin is the Director of Education and Development for Myron Steves, one of the largest, most respected insurance wholesalers in the southern U.S.

With Maine's tourism industry seeing record-breaking numbers of visitors in recent years, now seems like the perfect time to open up your own hotel in the state. But before those tired vacationers (or anyone else) can admire your impressive high thread counts, you'll need to get your business set up with the proper coverage. The risks of hotel ownership need to be considered up front.

That's where our independent insurance agents come in. They'll break down all kinds of hotel insurance available in Maine, from the coverage needed by small-scale boutique hotels all the way up to high-rise condo hotels. No matter what your occupancy rate is, they'll get you set up with all the protection you need. But until then, let's check out an overview of hotel insurance.

What Is Hotel Insurance?

In short, hotel insurance is a policy designed to cover all the components involved in your hotel's operation, from your property (i.e., the building, furniture, etc.) and employees, to services offered, and your guests. Obviously, all hotels offer different amenities and frills (or lack thereof), and your business's unique assortment of risks will influence your coverage needs.

What Does Hotel Insurance Cover?

A hotel insurance policy is typically the easiest route to take when it comes to navigating the right coverage for your business. This package offers most of the liability and property coverage you'll need, and your independent insurance agent can hook you up with any additional coverage your business needs. Let's take a look at an overview of what's typically covered.

Types of hotels covered:

- Premier and full service hotels: These hotels require the most comprehensive insurance packages, due to having such high occupancy spread across several hundred rooms, as well as offering tons of different services and amenities.

- Boutique hotels: With much lower occupancy rates, typically fewer than 100 rooms, and the lack of premier services or amenities (e.g., room service and fitness centers), these hotels carry less risk and don't require quite as much coverage.

- Condo hotels: These high-rise properties consist of of rooms typically owned as vacation homes that are rented out for short-term stays. Coverage requirements vary, and are determined by the allotted length of guest stays, how the unit is owned (by an individual or group), and the location of the hotel (which is usually a major city).

- Hotel management companies: Employee benefit strategies that help reduce claim costs and risk management are factors in the coverage needed by these companies.

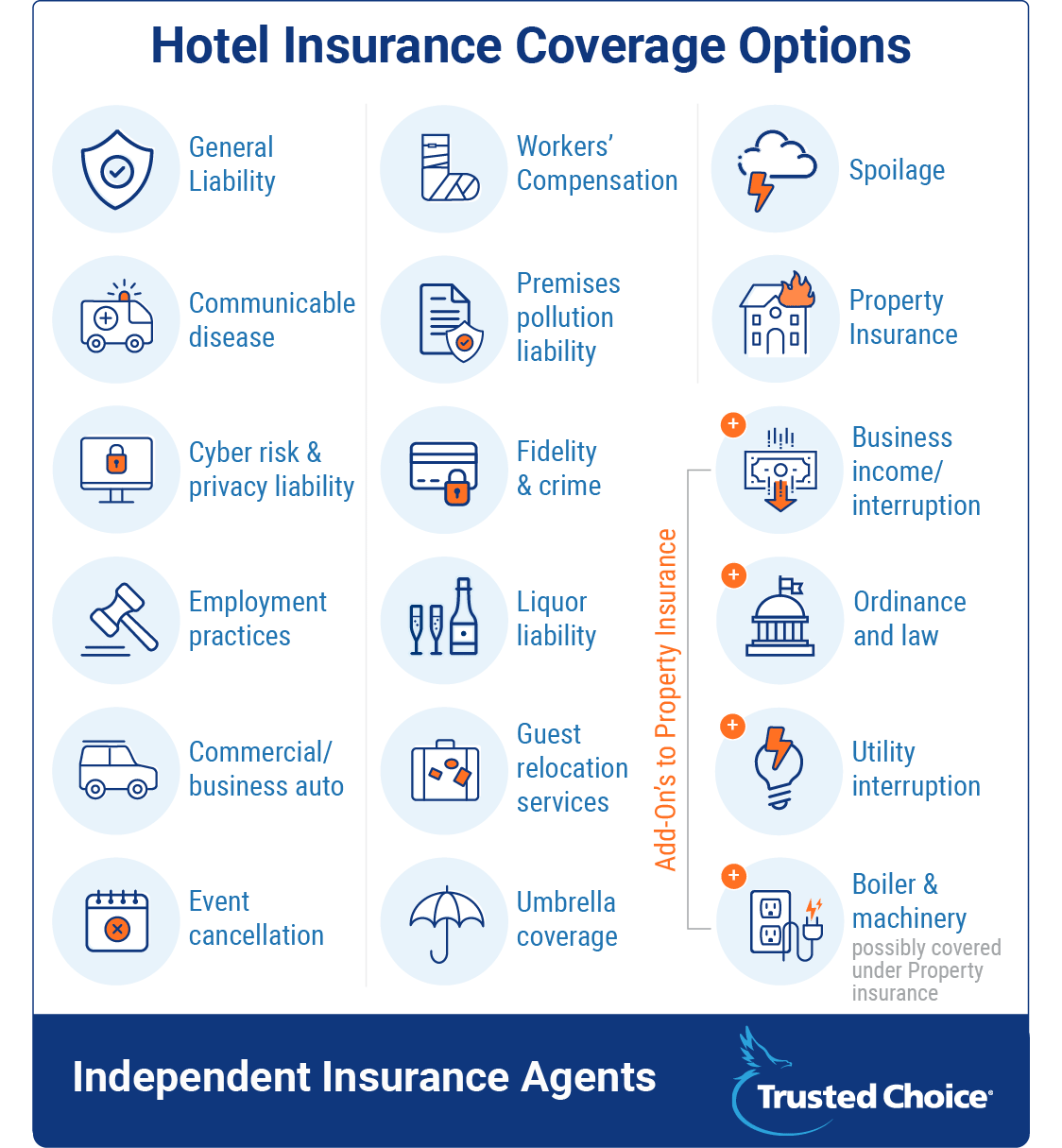

Insurance coverage options for your hotel:

- General liability: This coverage protects against lawsuits related to injury or property damage done by the business, and it's mandatory. Things like food poisoning claims would also fall under this category. Up to $1 million in coverage per hotel room is recommended.

- Workers' compensation: If your employees become ill, get injured or die from a work-related incident, this aspect of the insurance will cover the financial ramifications. Coverage is mandatory in Maine, as well as most other states.

- Property insurance: This covers any damage to your hotel's physical building, as well as the property inside it (e.g., furniture, carpeting, electronics, décor, etc.) in case of fire, etc. The type of cooking equipment used in your hotel's kitchen will contribute to the risk of fire damage, and may influence the cost of your policy. Coverage limits are typically $250 million per hotel location.

- Business income/interruption: A part of property insurance, this aspect covers the financial loss suffered while a business is closed due to fire damage or other disasters.

- Ordinance and law: Another part of property insurance, it covers the financial ramifications if your building is found to not be up to current state codes. Handicapped-compliant features, fire safety equipment, and emergency exits are all factors, here.

- Boiler & machinery: Also known as "equipment breakdown insurance," it covers electric equipment in the building (e.g., AC units, kitchen appliances, computers, etc.) that breaks down due to power surges, etc. Property insurance may cover this stuff, but not always.

- Utility interruption: An add-on to property insurance, this coverage applies to utility outages (e.g., phones, Internet, gas/electric/water, etc.) that cause damage to your property or result in a consequential loss.

- Spoilage: This coverage takes care of the replacement costs of food that spoils due to power outages caused by storms, surges, etc.

- Communicable disease: Covers any illnesses transmitted to customers due to improper hygiene of your employees.

- Premises pollution liability: Covers medical bills and cleanup costs if one of your guests becomes ill as a result of mold or other airborne pollutants.

- Cyber risk & privacy liability: Covers the financial ramifications if your hotel suffers a data breach resulting in the compromise of your guests' personal information. Coverage limits typically run up to $2 million.

- Fidelity & crime: Covers losses due to employee theft, computer fraud, credit card fraud, and stolen/damaged property.

- Employment practices: Covers court fees, should a disgruntled employee file a claim against you.

- Liquor liability: If your employees overserve a customer who ends up with a DUI or other alcohol-related charge (such as harming other guests or your property), this coverage is necessary because general liability will not protect you in these areas.

- Commercial/business auto: Provides protection for any company vehicles against things like theft, vandalism, and damage from natural disasters.

- Guest relocation services: Covers fees required in the event that your guests must be relocated due to an on-site incident.

- Event cancellation: Covers the financial ramifications in case a scheduled event must be cancelled.

- Umbrella coverage: This coverage provides a buffer against excess liability charges that reach beyond your existing liability policies' limits. Up to $100 million in this coverage may be added.

Your hotel insurance package will be assembled by selecting the coverages that work for your unique business from a comprehensive list of available options. Coverage limits define the maximum amount an insurance company will pay out for financial losses. Coverage applies to everything from lost business revenue to potential legal/court fees.

How Much Does Hotel Insurance Cost in Maine?

Short answer? It depends. On a lot. An older inn near the coast might pay around $5,000/year. But a fancy high-rise hotel just a few miles away might pay as much as $1,000,000/year.

To make things even more interesting, if these same two hotels were located just 10 miles further inland, their premiums might drop by half. In another state altogether, further away from the coast, the tiny one might pay $1,200/year, while the big one might pay $150,000/year. Really, it all depends on a (large) number of factors, like:

- The age of the hotel: The older a property is, the more of a risk it is to an insurance company. Newer hotels will get more slack with their premiums. Also, the type of construction, as well as whether the building is up to current state codes, may have been influenced by the time period the hotel was constructed in.

- The location of the hotel: If the hotel is located in a region of the country prone to a certain type of natural disaster, the premium will be much higher. But costs are determined down to the specific community surrounding the hotel (if it's in a safer neighborhood, this will present less risk). Also, every state has marked flood zones in it, and these high-risk areas will have higher premiums.

- The hotel's last update/renovation: The status of the building, as well as its furnishings and security systems, will really influence the cost of coverage. The more up-to-date and up-to-code everything is, the more lenient the cost.

- The number of safety/security features: The more security/safety features a hotel has, the less risk it presents to an insurance company. Hotels with current security systems, as well as safety features like sprinkler systems and handicapped-compliant features, will be favored by an insurance company.

- The age/condition of the roof: Older/more decrepit roofs are a higher risk to the hotel guests and the building itself, and therefore more of a risk to an insurance company.

- The size of the hotel: The square footage of the hotel, as well as the number of rooms, will influence coverage costs. Obviously, more rooms means more guests, which increases liability risk, and therefore means a higher premium.

- If rooms are rented out by other companies: If the hotel has community rooms that get rented out for meetings by other companies, this will increase the liability risk, and therefore costs, as well.

- If there is cooking on the premises: Hotels with kitchens present a risk for fire damage, and hotels with cooking equipment in the guest rooms further increase that risk — by a ton. However, fire safety features in the rooms and kitchen can help to decrease this risk (and cost).

- The parking lot's security: More security features in the hotel's parking lot can reduce the risk of claims filed by guests who experience damage or theft of their vehicles.

- If there is valet parking: Valet parking is another unique feature that increases liability needs, since the guests' vehicles are literally being driven by hotel staff.

- The experience level of the management: Insurance companies are interested in all kinds of details, including how experienced the hotel's managers are. Managers with more extensive training in risk prevention/crisis response can greatly reduce claims made by the property.

- The type/number of recreational features: If a hotel has a pool or a gym, obviously the risk of injury (or even death) increases, creating a need for more coverage.

- If the hotel serves/sells alcohol: If there is alcohol on the premises, liquor liability coverage will be necessary.

- If the hotel has any existing/past claims: Just like with any other type of insurance, if a hotel has any existing/past claims, the cost of coverage will increase.

Top 5 Hotel Insurance Claims in Maine

Maine is a hotspot for tourists and vacationers, thanks in part to its scenic coastline, shores, and beaches. But while the state's prime territory for boat tours and seafood, it's also susceptible to all the hazards that come with having an ocean for a neighbor. Without the right coverage, hotel owners risk their profits being washed away.

Here are some of the most common hotel insurance claims for The Pine Tree State:

- Windstorm damage: Hotels within a certain distance of the Atlantic coast are susceptible to windstorms and heavy rains. These storms can cause serious damage to property as well as revenue, especially if your hotel is forced to suspend operations.

- Fire damage: One in 12 hotels reports a structure fire annually, resulting in more than $60 million in property damage.

- Liability claims: Claims extend to all kinds of injuries or property damage, but the most common cases include stolen personal property and minor accidents like slips and falls.

- Data breach: In this digital age, the number of data breach claims is continually rising. Credit card breaches are among the biggest threats for hotel owners today.

- Business interruption: Regardless of a hotel's location, it's always prone to attacks by Mother Nature. Whether your hotel is nestled in an earthquake zone, flood zone, Tornado Alley, or anywhere else, you run the risk of losing precious income no matter what type of natural disaster forces you to temporarily close your doors.

Top 5 Ways to Score Hotel Insurance Discounts in Maine

Though the initial cost of a hotel insurance package may be unsettling, fortunately there are several strategies available that may help you to significantly lower your premium. Here are just a handful:

- Create a risk management action plan: Having a written plan of action to maintain the safety of your staff and guests in the event of an emergency can seriously impress an insurance company. Give your independent insurance agent a copy of the plan before they start hunting for quotes.

- Maintain your roof: Since roofs are among the most costly features of a property to replace, it might not be surprising that they can significantly influence insurance costs. Keep your hotel's roof in the best possible condition to help lower your premium.

- Keep your hotel up-to-date: The age of a hotel is one of the most influential factors when it comes to the cost of hotel insurance. Also, the older your property is, the more prone it becomes to breaking down or creating other hazards. Update your property, furnishings, and security systems (physical and cyber), and make sure that your building is always up to state codes.

- Make safety a priority: The safer your hotel, the less risk there is that a guest will become injured, and therefore, the less risk you will be to an insurance company. Install and maintain all safety equipment (like smoke detectors), keep elevators in working order, provide and label multiple exits, and oversee proper food handling procedures.

- Install a sprinkler system: Since fire damage is one of the top hotel insurance claims, reduce your hotel's risk (and premium cost) by installing an indoor sprinkler system.

Finding/Comparing Hotel Insurance Quotes in Maine

From insurance packages to add-on policies, our wise and helpful independent insurance agents will help you determine which types of coverage make the most sense for you. They'll compare policies and quotes from several different insurance companies to get you protection that's among the best around, at the best possible price. Basically, they'll get you covered.

https://www.pressherald.com/2018/04/04/tourism-spending-flatlined-last-year/

https://www.chicagotribune.com/lifestyles/travel/ct-maine-vacation-20170623-story.html