Comprehensive vs. Collision Car Insurance Explained

Knowing the differences between these two types of coverage can help you build a complete car insurance policy and better understand your protection.

Cara Carlone is a licensed P&C agent with 20 years of experience. She has her P&C license in RI and TX and holds CPCU, API, and AINS designations.

You need your vehicle to get you where you want to go, and you also need to be protected physically and financially when you drive. That’s where auto insurance comes in. But beyond any minimum mandated coverage, which type of car insurance do you need, and how much protection should you have?

Exploring the key differences between the two major types of auto insurance, comprehensive and collision, can help you answer these questions. A local independent insurance agent can also help you build a complete auto insurance policy that includes every type of coverage you need. But first, we'll explain how comprehensive and collision insurance work and why you might need either or both of these coverages.

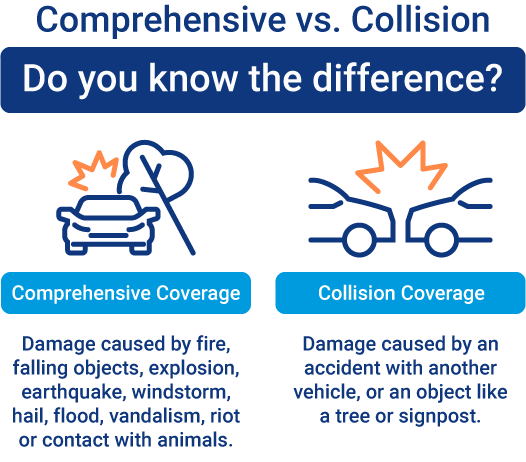

What’s the Difference Between Comprehensive and Collision Coverage?

Simply put, collision coverage pays for damage to your car when you collide with another object, regardless of fault. These objects could include a fence, guard rail, mailbox, post, or another vehicle. On the other hand, comprehensive insurance pays for damage to your car due to non-collision events, including theft and vandalism.

Both comprehensive and collision coverages go above and beyond the legally mandated minimum liability coverage, which pays for property damage and bodily injury you might cause to other drivers, passengers, or pedestrians.

While collision and comprehensive insurance aren’t required by law, they both offer valuable protection and should be considered when you’re deciding which type of auto insurance to get.

The term “comprehensive coverage” shouldn’t be confused with “full coverage,” which isn't a standard industry term but often is used to refer to an auto policy that includes at least liability, collision, and comprehensive coverage. Comprehensive insurance is only one type of coverage. In some states, comprehensive coverage is called “other than collision” to avoid confusion.

What Is Comprehensive Insurance Coverage?

Comprehensive coverage offers added protection for your vehicle and generally costs less than collision coverage. Comprehensive coverage can pay to repair or replace your vehicle if the damage wasn't caused by a collision with another car or object.

Comprehensive car insurance generally covers damage from the following:

- Natural disasters, including earthquakes, lightning, floods, hurricanes, and tornadoes

- Fire

- Riots and vandalism

- Theft

- Falling objects such as trees and hail

- Broken windshields

Comprehensive coverage is commonly called "other than collision." However, some collisions, such as hitting a large animal, are still covered under this policy.

What Is Collision Insurance Coverage?

Collision coverage pays for damage to your car if you hit another vehicle or an object like a telephone pole, a fence, or a mailbox. This coverage applies regardless of fault, meaning that even if the car accident was caused by you, your collision insurance could still cover damage to your own vehicle. Collision coverage reimburses you for the costs of repairing your car, minus the deductible, which is the amount you pay before insurance kicks in.

How Much Does Comprehensive vs. Collision Coverage Cost?

Collision and comprehensive coverage are often purchased together, but you can choose to buy one or both. Generally, comprehensive coverage costs much less than collision.

| Collision | Comprehensive | |

|---|---|---|

| Average Annual Cost | $743 | $421 |

Keep in mind that every driver is different, and those costs can vary widely depending on these factors:

- Car value: Expensive cars typically cost more to insure because replacement and repair costs are higher. The opposite is true for cheaper vehicles.

- Safety record: Traffic violations and accidents, particularly major offenses like DUIs, can cause your costs to skyrocket.

- Experience and age: The longer you’ve had your license, the less you’re likely to pay until you hit your senior years. Age is also a factor. Most drivers see a big drop-off in costs after age 25.

- Location: Different regions (called “rating territories”) have different risks that affect costs. For example, drivers in congested cities will likely pay more for insurance because heavy traffic is a risk factor for accidents, even if you’re otherwise a good driver.

To get a better idea of how much an auto insurance policy might cost you, use our car insurance calculator. A local independent insurance agent can also help you compare quotes for affordable coverage in your area.

Comprehensive vs. Collision Cost by State

The cost of comprehensive and collision insurance can vary greatly depending on where you live. Use the table below to find the average annual cost of collision and comprehensive car insurance in your state.

| State | Average Comprehensive Premium | Average Collision Premium |

|---|---|---|

| Alaska | $233 | $818 |

| Alabama | $391 | $711 |

| Arkansas | $466 | $816 |

| Arizona | $252 | $671 |

| California | $224 | $1,208 |

| Colorado | $811 | $682 |

| Connecticut | $188 | $800 |

| Delaware | $234 | $699 |

| Florida | $233 | $599 |

| Georgia | $330 | $708 |

| Hawaii | $156 | $717 |

| Iowa | $701 | $569 |

| Idaho | $235 | $695 |

| Illinois | $398 | $605 |

| Indiana | $325 | $637 |

| Kansas | $740 | $631 |

| Kentucky | $476 | $785 |

| Louisiana | $478 | $906 |

| Massachusetts | $230 | $784 |

| Maryland | $233 | $689 |

| Maine | $207 | $581 |

| Michigan | $522 | $1,091 |

| Minnesota | $671 | $699 |

| Missouri | $596 | $717 |

| Mississippi | $513 | $758 |

| Montana | $699 | $846 |

| North Carolina | $340 | $802 |

| North Dakota | $653 | $616 |

| Nebraska | $833 | $651 |

| New Hampshire | $189 | $626 |

| New Jersey | $183 | $716 |

| New Mexico | $444 | $830 |

| Nevada | $160 | $673 |

| New York | $314 | $645 |

| Ohio | $319 | $595 |

| Oklahoma | $591 | $750 |

| Oregon | $255 | $629 |

| Pennsylvania | $434 | $864 |

| Rhode Island | $194 | $961 |

| South Carolina | $390 | $579 |

| South Dakota | $1,246 | $651 |

| Tennessee | $319 | $743 |

| Texas | $448 | $725 |

| Utah | $236 | $711 |

| Virginia | $327 | $604 |

| Vermont | $227 | $733 |

| Washington | $185 | $606 |

| Wisconsin | $564 | $611 |

| West Virginia | $467 | $855 |

| Wyoming | $576 | $820 |

| Washington, D.C. | $266 | $1,018 |

Comprehensive vs. Collision Cost by Vehicle Type

How much you pay for comprehensive and collision insurance also depends on the type of vehicle you drive. The costs of these specific types of coverage are often the most affected by your vehicle type.

Refer to the table below for the difference in average annual car insurance premiums by vehicle type. These rates are for full coverage auto insurance, which are policies that include collision insurance, comprehensive insurance, liability insurance, and uninsured motorist insurance.

| Vehicle Type | Full Coverage Car Insurance Premium |

|---|---|

| Convertible | $3,023 |

| Coupe | $3,323 |

| Hatchback | $2,513 |

| Minivan | $2,084 |

| Sedan | $3,254 |

| SUV | $2,526 |

| Truck | $2,380 |

| Van | $2,073 |

| Wagon | $2,814 |

Note: These average full coverage car insurance premiums are based on policies that include coverage limits of 100/300/100 for collision insurance, comprehensive insurance, and uninsured motorist insurance.

Comprehensive vs. Collision Deductible

Collision and comprehensive coverages have separate deductibles, and you can choose different deductible amounts for each type. For example, you might adjust your collision deductible based on what you can afford for a collision claim. You can also choose the same deductible for both collision and comprehensive coverage. That way, you’ll have a rough idea of how much you’ll have to pay for all repairs.

Do I Need Comprehensive or Collision Coverage?

The type of coverage you need depends on the value of your car, how often you drive it, and whether you can afford to repair or replace it if you have an accident. Consider the following example scenarios.

- If you’re driving a car that has such a low value that repairs or a replacement would be cheaper than the premiums of additional policies, then you probably don't need more than the minimum mandated liability coverage in your area.

- If your car is worth more than $5,000, then full coverage auto insurance might be worth the premiums if you can afford it. At a minimum, you should probably have either collision or comprehensive coverage.

- If you need to choose between comprehensive and collision coverage, base your decision on the way you drive your car. If you commute in heavy traffic, collision coverage is probably the better choice, whereas comprehensive is better in disaster-prone or high-crime areas.

An independent insurance agent can help you choose between comprehensive and collision insurance or add both to your policy.

An Independent Insurance Agent Can Help You Compare Comprehensive and Collision Insurance

When it comes to finding the right collision or comprehensive car insurance, no one's better equipped to help than a local independent insurance agent. These agents can shop and compare car insurance quotes and policies for you from several local auto insurance companies. They can also help you determine which type of coverage makes the most sense for your unique needs and even file car insurance claims for you down the road.

https://www.iii.org/article/what-is-covered-by-collision-and-comprehensive-auto-insurance#:~:text=purchase%20these%20coverages.-,Collision%20coverage,your%20car%2C%20minus%20the%20deductible

https://www.iii.org/fact-statistic/facts-statistics-auto-insurance

https://www.insurance.com/auto-insurance/coverage/comprehensive-and-collision-auto-insurance.html

https://www.forbes.com/advisor/car-insurance/average-cost-of-car-insurance/